Insurance

Complete and partial loads departing from our company are under the guarantee of our FFL policy.

As of 2022, complete and partial loads departing from our company are under the guarantee of our FFL policy.

It is a policy that covers the liabilities arising from the transport contracts, whether related to the transport, transport, storage works or other works related to the transport, transport, storage works or other works of the transport of the transport companies engaged in national and international transport (Road, Airway, Maritime, Railway, Multimodal) and storage works, as well as the logistics services customary in transport, if they are related to the transport or storage of the goods, with the conditions and limits specified in the policy.

Freight Forwarder companies, which are the main suppliers of the logistics sector today, are the first party to be addressed against all justified or unjustified claims that may come to them due to damages that may occur during Road, Airway, Maritime, Railway, Multimodal and warehousing operations related to these transports, due to the transport contracts they have signed and the international conventions they have to comply with.

For this reason, all Freight Forwarder companies that do not have Forwarder Liability Insurance are open targets for all damages that may arise from cargo damage or delivery of the cargo to the wrong place. While Forwarder Liability Insurance fulfils justified compensation claims within the scope of policy conditions, it also protects the insured against unjustified claims. It is a flexible policy and tailor-made coverage, and premium can be provided according to the operational structures and needs of Freight Forwarder companies. Thus, Freight Forwarder companies are protected from unnecessary guarantees and premiums.

MAIN COLLATERALS

- All kinds of transports for which a freight invoice is issued and reflected in the transport turnover are covered.

- It covers all transports made with self-owned and/or hired vehicles, whether registered in the C2 List or not. Domestic and foreign license plate vehicles are also covered.

- Coverage can be provided for all or some of the International Road, Airway, Maritime, Railway and Multi modal transports.

- In addition to international transports, domestic transports (starting and ending within Turkey) are also covered. Thus, there is no need to have a separate “Domestic Carrier Liability” policy.

- The geographical scope of the policy is the whole world, including countries such as Afghanistan.

- Transfer depot risks are covered.

- If there are warehousing activities for commercial profit (long-term), these warehousing activities can also be covered upon request. Thus, there is no need to have a separate “Warehouseman’s Liability” policy.

- The coverage per vehicle for transport activities is EUR 1.000.000, – and can be increased according to demand and need.

- For warehousing activities, the coverage per claim is EUR 750.000, – and can be increased according to demand and need.

- Coverage is also provided for CMR Convention Article 21 (Payment against Demand Draft), Article 23 and Article 25 (Sales Invoice/SDR) and Article 29 (Gross Defect).

- There is no deductible in the policy (deductible in a certain percentage or amount of the damage), but it can also be prepared with deductible upon request.

- Transport of mobile phones, computers, electronic goods, alcoholic beverages, tobacco products and glass are also covered.

- Frigorific / Temperature Controlled products (medicine, meat, fish, citrus fruits, fruits and vegetables etc.) are also covered. Moreover, not only impact, collision, overturning, but also damages such as drying, rotting and deterioration due to heat are covered.

- Flammable/Explosive (ADR) products are also covered.

- Transit Carriage without prior notification is also covered.

- Wetness damages are also covered.

- Cargo recovery, lifting, re-carriage, destruction, loss and damage mitigation and detection costs are covered.

- As a result of the cargo being sent to the wrong place, the additional costs required to continue to the original destination are covered.

- Rights and claims according to criminal law (Abuse of Security) are covered.

- There is coverage for gross organizational defect, fundamental breach of duty and carelessness of representatives.

- Passive legal protection coverage is also provided with the policy. The policy defends the insured in Turkey and abroad not only against justified claims but also against unjustified claims and no additional fee is charged for this.

- All kinds of damages, losses and losses occurring in the goods transported because of refugees, immigrants, asylum seekers and other unknown perpetrators boarding the transport vehicle are also covered.

- The policy is governed by Turkish Law and Turkish courts are authorized.

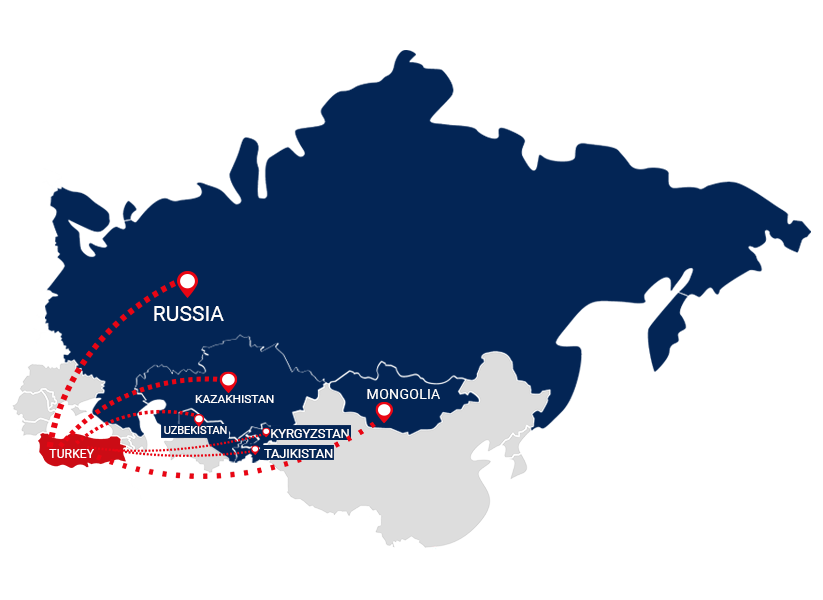

Get Detailed Information About Our Transportation Routes Departing from Turkey!